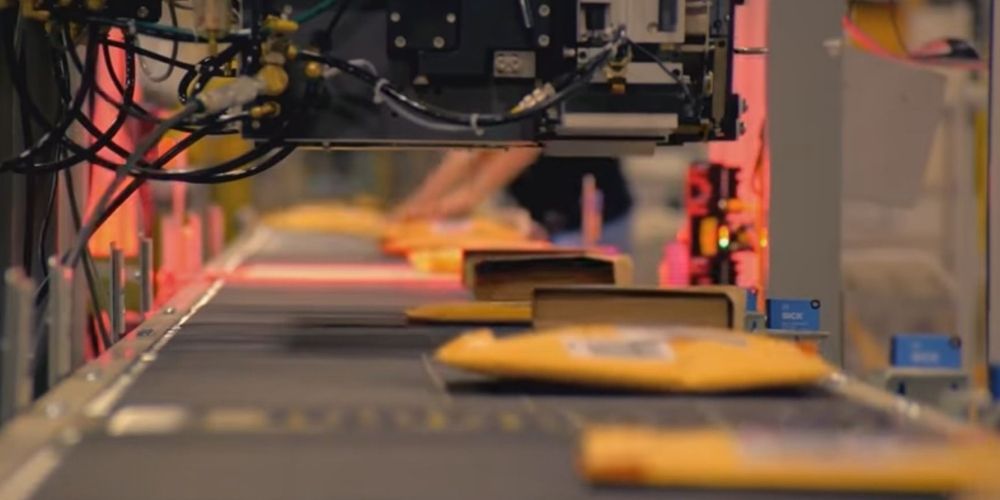

Revenue figures for 2020 showed that nearly 50% of Amazon sales were generated by third-party sellers, with two-thirds of these independent sellers using Amazon’s Fulfilment by Amazon (FBA) service. FBA allows businesses to utilize Amazon’s logistics network, from storing to receiving, packing, shipping, customer service, and processing order returns.

The FBA motto—“You sell it, we ship it”—encapsulates the effective and reliable way an independent business can use the eCommerce giant’s considerable resources to grow and expand its customer base. Worldwide, over two million retailers take advantage of FBA to distribute their products and provide optimal customer service.

This article will discuss how owners of FBA businesses (or those advising businesses on how to sell on Amazon) can sell their business. This information may also be helpful to Amazon Delivery businesses. However, despite their dependency on Amazon, these businesses operate slightly differently (i.e., more similar to a local, physical store).

Note: Sellers of widgets will benefit significantly from utilizing FBA.

Before Selling Your FBA Business—The Minimum Requirements

First and foremost, you need to establish whether or not it’s wise to sell your Amazon FBA business yet. What follows are the minimum requirements that should be in place before even considering selling:

1. Generating a minimum of $100,000 in annual profit

Any business looking to sell should preferably be generating at least $100,000 in profit annually before expenses. When evaluating a business’s value, most buyers will be looking at profit instead of solely at revenue. The possible exception is strategic buyers willing to redesign the business model and therefore eradicate any duplicate expenses rapidly.

2. Having a stable revenue

Your business revenue should be consistent with no recent decline. Ideally, your revenue should have a positive and upward trend.

3. Documented processes

Your business should be operating with employees following documented procedures and processes and with minimal dependency on you, the business owner. Ideally, your role should be that of a general manager rather than a technical one. In that case, a new owner will be able to jump into your role more efficiently and quickly.

Preparing Your Amazon Business for Sale

Now we’ve established the minimum requirements for selling, let’s take a look at how you can prepare your business to sell. The steps we’ve outlined below are just a guide; you may find that you can/want to skip certain points, but generally, the more you put into the preparation, the easier the sale and the greater the financial reward.

Your goal pre-sale should be minimizing buyer’s risk. As value is a function of risk, the lower the risk of the income stream being interrupted, the lower the buyer’s risk, and therefore the more valuable your business.

We’ve prioritized the steps below to enable focus on preparations aimed at quick wins, thus significantly reducing risk.

1. Reduce dependency

Nearly every buyer will be concerned about a business’s dependency—and Amazon businesses are certainly not immune. Dependency on outside factors can include supply, marketing, central employees, products, etc. If your business is less dependent on any variable, it inherently lowers the buyer’s risk.

Every Amazon business will have weaknesses in different areas regarding dependency. Therefore, reducing dependency will vary from business to business. To reduce dependency in your business, you’ll need an objective eye to determine where its weaknesses lie.

Generally, there are several strategies that all businesses can take on board—for example, aiming to balance organic growth with external paid growth, developing various branded or exclusive products, and cultivating solid relationships with suppliers who can provide backup if there are delays.

In some cases, dependencies can’t be reduced, and there may be an excess of risk factors. If that’s the case for your business, one option is selling your company centered on an earnout where the buyer will only have to pay if a certain level is reached. Although this option is not ideal as it takes careful drafting and contingent payment is inherently risky, it may be the only way you’ll be able to achieve a sale if your business is heavily dependent on one or many factors.

2. Increase barriers to entry

Any potential buyer will evaluate how easy or difficult it is to replicate your business from scratch. If a competitor thinks it’s possible, they will then ask themselves if they could do so at a lower cost. If they deduce that it is possible, any sale will likely not occur.

It’s therefore vital that you strengthen your business (and its selling potential) by reducing its potential to be replicated. You can do this by developing barriers to entry, such as legal, technical, strategic, and branding. For example, you’ll be at an advantage if you have an excellent Amazon seller rating, a website external to Amazon, robust relationships with your suppliers, trained employees who have long-term employment contracts, and trademarked or branded products.

You may also consider developing alternative strategies to increase output and sales (i.e., organic growth). However, ensure that it’s feasible to gain momentum with these, or else you’ll be unable to demonstrate a basis for your projection assumptions.

3. Keep clean financial statements

Your business will appeal more to potential buyers if your financial statements and federal income tax returns show a maximized profit amount and minimize personal expenses. Clean financial statements mean an increased likelihood of a potential buyer obtaining the necessary financing to buy your business, therefore reducing (or eradicating) how much you need to finance.

If a business’s tax returns show a high profit, the more it can support debt service when a bank calculates whether or not it can finance the transaction.

Minimize personal expenses run through the business at least two years before you wish to sell. Do this because when banks calculate cash flow, they don’t allow most personal adjustments to financials. Therefore, keep a separate business account with no personal transactions.

Keep any significant/one-time expenses or long-term investments to a minimum. Examples of this would include actions such as developing new products or renovating business premises. If these investments are necessary, it’s best to capitalize them. Therefore, they will appear as depreciation on the business’s profit and loss statement and then put back while calculating Seller Discretionary Earnings (SDE).

4. Develop a complete training and transition plan

Often, potential buyers of online businesses have little or no experience in that industry. As you’ll put yourself at an advantage by making your business appeal to as many types of buyers as possible, don’t ignore this group. Novices will often buy at higher purchase prices, and your business will be made more appealing to them if you have a thorough training and transition plan in place.

Training and transition plans can combine internally and externally produced materials. Internally produced items include instructions, checklists, manuals, and documented processes. Externally produced materials include tools such as trade association training, guides, forms, training videos, and education materials from outside sources.

However, ensure that a potential novice buyer isn’t overwhelmed by the amount of information you provide them. Your training and transition plan should be comprehensive but include a custom-made framework according to the buyer’s experience and background. Any material that the buyer will already be familiar with should be removed from the plan.

Additionally, essential information should be distinguishable from helpful information (e.g., they need to know the business’s supplier relationship terms, while a comprehensive guide to new product development is more helpful than essential information).

Potential buyers should also be reassured that you’ll be available for long-term consultation. Your plan should include how they can contact you for ongoing support. Pick your preferred means of communication (e.g., emailing, calling, on-site visits, etc.) should they need your advice or input.

Having a training and transition plan already in place when meeting with potential buyers puts you at a great advantage. Any doubts they may have due to their inexperience will be eased when presented with a clear and comprehensive guide, including modules and accompanying materials.

Take some time to go through the training plan and give relevant timeframes. The more confident the potential buyer will become that the transition will be relatively smooth and that you’ll also be available to them for support in the long term.

Remember that buyers are taking a risk, and novice buyers, in particular, may fear that they have even more to lose. Doubts and fears will kill any potential deal, especially if someone is preparing to hand over substantial amounts of net worth to own a business in an industry that they’ve never dealt in before. Always picture yourself as the potential buyer: how would you be feeling, and how would you feel reassured?

With a robust, clear, comprehensive (but not overwhelming) training and transition plan, you’ll be able to put a novice buyer’s main fears to rest. This plan, therefore, has the potential to be one of the essential tools in your selling kit.

5. Have a persuasive reason to sell

Most buyers will be wondering why you want to sell your Amazon business. Their suspicions may be raised if they see you’re young and not relocating or if the business is growing in a positive trajectory, yet you want to sell.

Whatever the reason you give to potential buyers, make sure it’s honest. Whether you’re selling because you’re burned out, bored, or ready to move on to something entirely new, let them know. It’s likely that, as fellow entrepreneurs, they’ll empathize. If anything, they’ll appreciate that you’re frank with them, which will build their trust in you and help facilitate a potential sale.

Turn any information (objective or subjective) into an opportunity, even a challenge, for a buyer. Buyers will, more than likely, have a competitive spirit. Has one of your business competitors developed a superior product to your own? Tell the potential buyer, then explain that this is a normal, natural part of the industry, where businesses are looking to create new versions of existing products.

Then explain how you want to take time away from the business and travel using the fruits of your financial success. However, you don’t want the success you’ve built for your business to be laid to waste. Tell the buyer this is where they can step in: they can continue to look for new, innovative ways to create products to outsmart the competition and ensure the business continues on a positive trajectory.

Buyers will appreciate your candor while simultaneously champing at the bit to take on a fresh challenge or continue with your business’s success.

6. Prepare for the scrutiny of a buyer’s due diligence

Next, you’ll need to prepare hundreds to thousands of business documents (financial statements, Amazon statements, bank statements, seller lists, invoices, etc.) for the buyer’s due diligence.

You may wish to share your company’s information with buyers either through an online repository, digitally, or through physical records. For safety and confidentiality, we recommend printing out physical copies for the buyer to examine in your own office and not being able to take any copies with them. Bear in mind that if sharing this type of sensitive data, it’s best only to do so if the price and terms have been agreed upon, there has been an acceptance on the offer to buy, and an earnest money deposit has been made.

7. Build processes and systems infrastructure

You’ll find that most potential buyers will be dissatisfied corporate executives who want to switch from their successful careers in, say, the tech industry to one in an Amazon FBA. They may have the cash, equity, and retirement funds but are unlikely to have any experience in this industry.

To reduce buyer risk (and make your Amazon FBA business more appealing to prospective buyers), you should have a processes and systems infrastructure in place. Potential buyers will want to be reassured that your business is not highly dependent on you. A business with systems and processes will help reduce dependency and therefore increase the potential for any buyer to own and operate it themselves.

8. Contact Amazon regarding account and customer reviews transferability

You’ll need to contact Amazon seller support to obtain the list of procedures regarding account and customer reviews transfer. Ask them if your account can definitely be transferred to the new buyer and that there are no issues that will prevent this from happening successfully.

9. Valuing your Amazon FBA business

The average Amazon FBA business is sold at a multiple of 2.0 to 3.0 of Seller’s Discretionary Earnings, and its value is based on profit and not revenue. Therefore, a business will be worth more the higher its earnings.

Risk is the main factor influencing an Amazon FBA business’s value (a lower risk, a higher multiple, a higher risk, a lower multiple). Therefore, anything you can do to reduce risk to the buyer when selling your business will increase its value. Nevertheless, there are also other ways in which your business’s value can be affected:

- Dependency: Your business’s worth decreases in correlation to the amount of dependency on marketing channels or products.

- Business’s age: A business’s worth increases with its age. (Note: This must involve a history of stable or positive revenue growth.)

- Growth: A higher growth trajectory will increase your business’s worth.

- Competition: If your business niche is more competitive, your business will be valued less.

- Barriers to entry: If your business has more barriers to entry (e.g., strong branding, trademarking, patents, good customer reviews, trade secrets, etc.), the more it’ll be valued.

- Margins: Higher margins (as long as they are stable and not declining) result in higher business worth.

- Customer reviews: If your business has consistently positive and high numbers of customer reviews, the higher it’ll be valued.

- Owner’s duties: If you are going to be difficult to replace (e.g., you work long hours, have a more technical role, etc.), the less your business will be worth to a potential buyer. A business won’t be valued highly if an owner’s role has to be replaced by a technical expert, as this, among other factors, will reduce earnings.

- Staff: A business employing a higher quality of staff will increase the company’s value. Staff experience, satisfaction, longevity, and permanent employment contracts all increase this worth.

10. Finding buyers

a) Types of buyers

Although you’ll find various types of interested potential buyers, these will likely be individuals, including internet entrepreneurs or people in the corporate world. Keep an eye out for complete novices to Amazon FBA businesses. They may be using you to merely learn about the industry, with no intention of actually buying your business.

Be aware of “buyers” asking questions about the behind-the-scenes mechanisms rather than genuine buyers who are more likely to be trying to evaluate how investing in your business will make financial sense to them.

As well as being careful to determine between genuine and not-so-genuine potential buyers, also be aware that not-so-ideal buyers share similar personality traits. If a buyer appears to be overly analytical or hypercritical regarding the potential risks of buying, then they’re unlikely to take the leap and invest in your business.

Instead, potential buyers who have already analyzed and accepted the potential risks are more likely to have a genuine interest. Look for individuals who have a background in industries such as tech, marketing, sales, project management, management, etc. In other words, people who are used to making judgments and decisions without being equipped with the whole picture.

Ideally, you’ll be looking for a strategic buyer, but this is more unlikely in the case of Amazon FBA businesses. Additionally, they’re less likely to accept a higher purchase price than individuals—especially novice buyers.

b) Ways to find buyers

Accessing online marketing platforms: You can take advantage of the numerous online portals designed for selling businesses. These channels will help you attract any type of buyer.

You just need to research how best to use these databases and watch the buyers come to you. However, there are limitations to using these channels if your business is relocatable. Still, if you learn to work around this, you should be able to market your business and attract all types of buyers.

Using buyers’ databases: There are some databases maintained by brokers that contain the details of interested buyers. These databases can be used as a starting point for finding potential buyers (although bear in mind that the brokers will only have a strong relationship with a handful of the database entries).

Contacting businesses directly: If your company manufactures and sells proprietary products, you could contact brick-and-mortar or online companies selling similar products but without an existing Amazon presence.

11. Starting due diligence

Due diligence begins once an offer is accepted. It would be best if you acted with extreme caution at this stage, as you may find that certain buyers will be seeking out competitive information. We suggest taking the following steps to help protect yourself and your business before starting due diligence:

- (i) Request an earnest money deposit.

- (ii) See that the buyer is spending money on the sale (e.g., on accountants, lawyers, etc.).

- (iii) Obtain proof of the buyer’s financial qualifications.

- (iv) Hire an experienced advisor (e.g. website broker) who’ll be able to evaluate the true extent of the buyer’s interest and whether or not they’re merely seeking competitive information.

12. Closing the sale

Closing the sale of an online business is materially similar to that of other types of businesses. As it’s online, the closing will be digital; the money will be wired several days post-closing, and the signing of the closing documents will be done electronically. Access to your business’s technology (website, online accounts, etc.) can be escrowed and released post-closing.

The Takeaway

Although there are similarities in selling an Amazon FBA business as with more traditional brick-and-mortar companies, there are differences. By understanding what these differences are, the easier and more profitable your sale will be.

This article has outlined what minimum requirements you should have in place before trying to sell your Amazon FBA business. It’s also advised how to prepare your business for sale and thus make it more appealing to buyers. We’ve given tips on how to capitalize on your company’s value, find the right buyer, and protect yourself and your company from not-so-genuine potential buyers.

By incorporating these points (or picking and choosing those most relevant to you), you should be able to consolidate your business’s strengths and reduce any weaknesses, thus achieving the best possible sale for your company.